Questions to Consider:

Behavioral control

- Instructions: An employee is given instructions on how, when, and where to perform the work, while a contractor is not.

- Training: The hiring entity does not train an independent contractor on how to do their job; the contractor uses their own methods.

- Personal services: The contractor usually has the right to hire others to do the work, whereas an employee typically must perform the services personally.

Financial control

- Investment: An independent contractor often has a significant investment in tools, equipment, or a business, while an employee does not.

- Expenses: An independent contractor may have unreimbursed business expenses, while an employee’s expenses are often reimbursed.

- Opportunity for profit or loss: A contractor’s opportunity to earn a profit or incur a loss based on their managerial skill is a key indicator of independence.

- Payment: Contractors are often paid a flat fee for a job, while employees are usually paid an hourly or salary wage.

Type of relationship

- Permanency: The relationship is typically less permanent for an independent contractor than for an employee.

- Integration: The work performed by an independent contractor is often not an integral part of the hiring company’s main business activities.

- Benefits: Independent contractors do not receive employee-type benefits like health insurance or vacation pay.

- Written contract: A written agreement stating the worker is an independent contractor is considered, but it is not the only factor.

https://www.dol.gov/agencies/whd/fact-sheets/13-flsa-employment-relationship

“Governor Hochul signed legislation on November 22, 2023, creating protections for independent contractors that are very similar to the requirements of New York City’s Freelance Isn’t Free Act.

The law creates a new section of the New York Labor Law, 191-D, and sets forth wage and job protections for freelance workers in New York State. The law defines “freelance worker” as any person or an organization composed of only one person (in other words, an individual contractor’s corporation) hired as an independent contractor for at least $800. It excludes construction contractors.

The law requires companies who enter into covered agreements with freelance workers to reduce the terms of the agreement to writing, provide a written copy of the contract to the freelance worker, and include the following minimum information in the contract:

- The name and mailing address of both the hiring party and freelance worker

- An itemization of all services to be provided by the freelance worker, the value of these services, and the rate and method of compensation

- The date on which the hiring party must pay the contracted compensation or the mechanism by which such date will be determined (if this provision is not included, then payment must be made no later than 30 days after the completion of the freelance worker’s services)

- The date by which the freelance worker must submit a list of all services rendered to meet any payment processing deadline of the hiring party

The hiring party is required to keep contracts for at least six years. The bill provides that the failure to produce a freelancer contract upon request by the NY DOL shall give rise to a presumption that the terms that the freelance worker has presented are the agreed upon terms. The law also requires the NY DOL to create template contracts, although companies would not be prohibited from creating or continuing to use their own.

Under the law, any freelance worker can file a confidential complaint with the NY DOL. The bill expressly provides that failure of a hiring party to keep adequate records can expose them to penalties and, in the absence of any records, “the hiring party…shall bear the burden of proving that the complaining employee was paid in accordance with this section.” The bill also gives freelance workers protection from intimidation, harassment, or discrimination for exercising their rights under the law.

Finally, the law provides a private right of action and six-year statute of limitations, except for claims regarding failure to provide a compliant written contract, which have a two-year statute of limitations and require a plaintiff to demonstrate they requested a written contract before the work began. Statutory damages for failing to provide a written contract are set at $250. Liquidated damages and attorney fees are available for a plaintiff who prevails on claims regarding failure to timely pay for services owed or retaliation.

The law takes effect on May 20, 2024, and applies only to contracts entered into on or after that date.” (Morgan Lewis)

https://www.morganlewis.com/pubs/2023/12/new-york-state-year-end-legislative-developments-for-employers-to-know

https://www.jdsupra.com/legalnews/new-york-state-2024-employment-law-6603981/

Additional Freelance Legal Protections by State & City

https://freelancerfiles.com/blogs/news/5-states-cities-are-now-regulating-freelance-work-in-the-us-here-s-what-you-need-to-know

Federal Updates:

The federal article below continues to evolve, expect more changes defining independent contractors at the FEDERAL DOL with the Trump Administration.

Trump DOL Pauses Biden Independent Contractor Rule Defense

The U.S. Department of Labor announced Tuesday a final rule revising its interpretation of the Fair Labor Standards Act’s classification provision to determine whether a worker may be considered an independent contractor.

The final rule largely tracks the agency’s October 2022 proposed rule. It retains the multifactor, “totality-of-the-circumstances” framework for analyzing independent contractors’ status included in that proposal.

Under this framework, DOL will consider six non exhaustive factors when examining the relationship between a worker and a potential employer:

- Worker’s opportunity for profit or loss.

- Investments made by the worker and the employer.

- Degree of permanence of the work relationship.

- Nature and degree of control over performance of the work.

- Extent to which the work performed is an integral part of the employer’s business.

- Use of the worker’s skill and initiative.

The rule will be published in the Federal Register on Wednesday, Jan. 10, and is slated to take effect March 11, officials said. (HR Dive)

Current Independent Factor Test

“An employment relationship under the FLSA must be distinguished from a strictly contractual one. Such a relationship must exist for any provision of the FLSA to apply to any person engaged in work which may otherwise be subject to the Act. In the application of the FLSA an employee, as distinguished from a person who is engaged in a business of his or her own, is one who, as a matter of economic reality, follows the usual path of an employee and is dependent on the business which he or she serves. The employer-employee relationship under the FLSA is tested by “economic reality” rather than “technical concepts.” It is not determined by the common law standards relating to master and servant.

The U.S. Supreme Court has on a number of occasions indicated that there is no single rule or test for determining whether an individual is an independent contractor or an employee for purposes of the FLSA. The Court has held that it is the total activity or situation which controls. Among the factors which the Court has considered significant are:

- The extent to which the services rendered are an integral part of the principal’s business.

- The permanency of the relationship.

- The amount of the alleged contractor’s investment in facilities and equipment.

- The nature and degree of control by the principal.

- The alleged contractor’s opportunities for profit and loss.

- The amount of initiative, judgment, or foresight in open market competition with others required for the success of the claimed independent contractor.

- The degree of independent business organization and operation.

There are certain factors which are immaterial in determining whether there is an employment relationship. Such facts as the place where work is performed, the absence of a formal employment agreement, or whether an alleged independent contractor is licensed by State/local government are not considered to have a bearing on determinations as to whether there is an employment relationship. Additionally, the Supreme Court has held that the time or mode of pay does not control the determination of employee status.

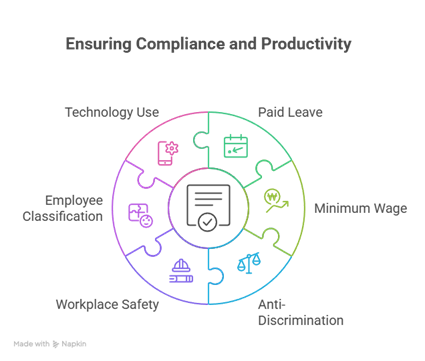

Exempt and nonexempt, hourly, salaried, and salaried nonexempt are definitions that most of us know and currently use to classify the positions in our organizations. We know that we must classify individuals in an exempt or nonexempt (overtime eligible) position for payroll, overtime and reporting purposes. There are numerous definitions to define exempt level positions under the current FLSA (federal) regulations.

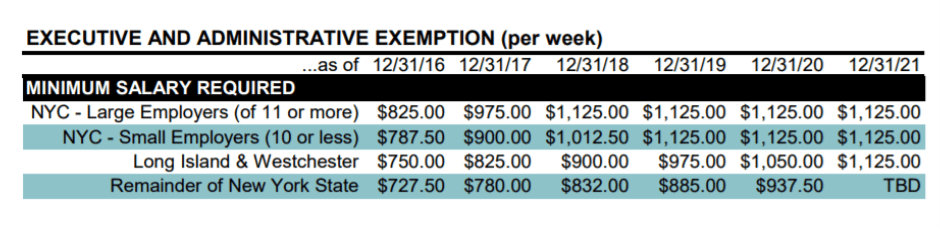

Remember that the salary threshold in New York State varies for executive and administrative professionals, when comparing with the federal law. As leaders, we need to ensure our classifications for each position within our organizations are accurate and our workforce is paid correctly for work performed and hours worked.”

(https://www.dol.gov/agencies/whd/fact-sheets/13-flsa-employment-relationship)

https://www.dol.gov/agencies/whd/fact-sheets/13-flsa-employment-relationship

National Labor Relations Board June 2023 Ruling

“A new ruling from the National Labor Relations Board (NLRB) alters the standard employers must use to determine whether someone qualifies as an independent contractor.

In the June 13 ruling, the board concluded that the makeup artists, wig artists and hairstylists who work at the Atlanta Opera are employees, not independent contractors. The workers had filed an election petition with the board, seeking union representation.

The NLRB rejected the previous ruling in SuperShuttle that entrepreneurial opportunity for gain or loss should be the animating principle of the independent contractor test. Instead, it said entrepreneurial opportunity should be taken into account alongside a list of traditional common-law factors.

Those factors include:

- The extent of control the employer exercises over the details of the work.

- Whether the work is usually done under the direction of the employer or without supervision.

- Whether the worker is engaged in a distinct occupation or business.

- How much skill is required in the particular occupation.

- Whether the employer supplies the tools and the place of work.

- The length of time for which the worker is employed.

- The method of payment, whether by the hour or by the job.

- Whether the work is a part of the regular business of the employer.

“Applying this clear standard will ensure that workers who seek to organize or exercise their rights under the National Labor Relations Act (NLRA) are not improperly excluded from its protections,” said NLRB Chairman Lauren McFerran.

The SuperShuttle ruling “cannot be squared with board precedent, with the common law, or with Supreme Court precedent,” the NLRB wrote in its opinion.

In this case, the creative workers did not have true entrepreneurial opportunity because in reality there was no other opera across town that they could take their talents to, according to David Korn, an attorney with Phelps Dunbar in New Orleans.

“Hypothetical opportunity should not be considered,” said James Evans, an attorney with Alston Bird in Los Angeles.

The new ruling “is designed and intended to make it much more difficult for employers to classify workers as independent contractors and therefore avoid the potential for those workers to organize,” said Jason Reisman, an attorney with Blank Rome in Philadelphia. “This new decision will serve potentially as a solid deterrent for many employers and create doubt for others, or at least make them think twice and re-evaluate how and how often they utilize independent contractors.”

In light of the NLRB decision, “it might be time to reevaluate what our written agreement looks like” for independent contractors and how it’s working in practice, said David Pryzbylski, an attorney with Barnes & Thornburg in Indianapolis. “Anybody using independent contractors needs to take notice of this. The gig economy is top of mind.”

“Employers should know it is not enough to rely upon the method of payment or industry past practices and norms to classify and treat service providers as independent contractors,” said Michael Gotzler, an attorney with Littler in Madison, Wis. “The legal risks and attendant financial exposure are too great nowadays for any business to ignore this evolving area of law.”

However, Todd Lebowitz, an attorney with BakerHostetler in Cleveland said, “This is a low-impact decision. More than anything else, it just reflects that different board members have different perspectives when applying the same common-law test, just like different judges have different perspectives when applying the same test,”

How Employees Differ from Independent Contractors

Under federal law, employees may be entitled to union rights, minimum wage, overtime pay and other benefits. Independent contractors are not entitled to such benefits, but they generally have more flexibility to set their own schedules and work for multiple companies.

Contractors can’t form unions and can’t file unfair labor practice charges with the NLRB, Pryzbylski said.

SHRM filed a friend-of-the-court brief with the NLRB in favor of keeping the SuperShuttle standard. “In order to recruit and retain the best talent, especially during these challenging economic times, [businesses] must offer a myriad of work relationship options that provide the 21st-century worker the autonomy necessary to make the best decisions for them and their families. To that end, the availability of independent work is not only valuable to workers, but necessary for businesses to compete in today’s global marketplace,” SHRM stated, noting that almost 50 percent of Generation Z and 44 percent of Millennials engage in some form of independent work.” (SHRM)

What Is the Most Common Test for Independent Contractors?The ABC test is the most common test used for determining whether someone is an independent contractor. If an employee meets all three of these conditions, they are considered to be an independent contractor.

Conditions of the ABC test:

- Condition A — The individual must be free from the direction and control of the hiring entity. This includes the execution of the work and how the employee is supervised.

- Condition B — Second, the independent contractor has to perform work that is considered to be outside the scope of the hiring entity’s business. For example, a software company may hire someone to fix its plumbing system.

- Condition C — Finally, the worker must be engaged in an independently established occupation, business, or trade that is the same as the work they are performing.

Condition B is particularly challenging for many contractors to meet and is often criticized as overly restrictive. For example, a self-employed freelance journalist hired by a magazine or website to write an article would be unable to meet Condition B because their line of work is the same as that of the hiring company: producing written content. The same would apply to many temporary workers, including a musician hired to fill in for an unavailable band member, a carpenter hired to help a construction firm build a house, or a baker hired to help a caterer with a particularly large event.

To alleviate for Condition B’s unintentional heavy-handedness, many states pass additional laws, such as California‘s AB 2257, giving certain professions exemptions from Condition B (or the ABC test as a whole).

Common Law Rules for independent contractors:

States that do not use the ABC test typically use the similar Common Law Rules as outlined by the US Internal Revenue Service (IRS). The answers to the common law questions help determine if a worker is considered an independent contractor or a full employee.

- Behavioral control: Does the hiring company control the worker and/or the methods they use to complete the work?

- Financial control: Does the hiring company control aspects of the worker’s compensation, such as how they are paid, if expenses are reimbursed, and who furnishes needed supplies?

- Relational control: Does the hiring company offer the worker benefits such as insurance or vacation pay? Is the work being done part of the hiring company’s main business? Is the working relationship ongoing?

What States Use the ABC Test?

There are several states that commonly use the ABC test to decide whether someone is an independent contractor. These include Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Hawaii, Illinois, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, Ohio, Oregon, Rhode Island, Tennessee, Utah, Vermont, Washington, and West Virginia. Anyone working as an independent contractor in these states must pass the ABC test if they want to be classified as such.

Any other states generally have requirements that are very similar, but there may be a few differences. For example, several states require the contractor to meet only conditions A and C of the ABC test or utilize Common Law Rules instead.

https://worldpopulationreview.com/state-rankings/independent-contractor-laws-by-state

Employee or Independent Contractor?

The most basic question about the employment relationship is whether a worker is, in fact, an employee or an independent contractor. As with so many employment law issues, the answer is it depends. In this case, it depends on who is asking: the Internal Revenue Service (IRS), the U.S. Department of Labor (DOL), a workers’ compensation hearing officer and so on. Even courts have admitted that the distinction is not always clear. Regardless of what the employer calls the worker; contractor, freelancer, consultant or gig worker, the same principles apply. SeeNavigating Employment Law in the Gig Economy.

Employee status triggers employer obligations under various federal and state laws that do not apply to independent contractors, and the responsibility for classifying a worker correctly falls squarely on the employer. HR professionals must understand the practical and legal differences between employees and independent contractors.

No bright-line test exists to determine when a worker should be classified as an employee rather than as an independent contractor. However, a wealth of information is readily available to help organizations make the necessary case-by-case determinations. Once the decision has been made to meet a staffing need through independent contractors, organizations can take several practical steps to manage independent contractors effectively.

SeeBLS: Contingent and Alternative Employment Arrangements Summary and Gigs Are the Future of Work: A Q&A with Sarah Kessler.

How to Classify Properly

No legal test applies in every situation when deciding to classify a worker as an independent contractor. For example, the IRS and DOL use different, although similar, analytical frameworks. In fact, the multiplicity of tests defining independent contractor status applied across federal and state laws makes it possible for a worker to be classified as an independent contractor under one law but as an employee under another.

To minimize legal risk, employers are well-advised to ensure that classification as an independent contractor would satisfy every test that may be applicable where the organization does business.

TESTS FOR INDEPENDENT CONTRACTOR STATUS

Various federal government agencies and some states have their own tests to determine independent contractor status.

DOL. According to the DOL’s Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act, “The U.S. Supreme Court has on a number of occasions indicated that there is no single rule or test for determining whether an individual is an independent contractor or an employee for purposes of the FLSA. The Court has held that it is the total activity or situation which controls.” The following factors have been considered significant in determining independent contractor classification:

- The extent to which the services rendered are an integral part of the principal’s business.

- The permanency of the relationship.

- The amount of the alleged contractor’s investment in facilities and equipment.

- The nature and degree of control by the principal.

- The alleged contractor’s opportunities for profit and loss.

- The amount of initiative, judgment, or foresight in open market competition with others required for the success of the claimed independent contractor.

- The degree of independent business organization and operation.

SeeMisclassification of Employees as Independent Contractors and DOL Issues Guidance on Independent Contractors.

Additionally, some statutes enforced by the DOL, such as the federal Service Contract Act, contain their own definitions of what constitutes an employee for purposes of the statute. SeeEmployee coverage does not depend on form of employment contract.

IRS. As reflected in Section 2 of its Publication 15-A: Employer’s Supplemental Tax Guide, the IRS now looks at 11 factors (rather than the previous 20 factors) within three areas:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (These include such considerations as how the worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee-type benefits (e.g., pension plan, insurance, vacation pay, etc.)? Will the relationship continue, and is the work performed a key aspect of the business?

SeeIndependent Contractor (Self-Employed) or Employee?

Organizations or individuals can request an official determination of a worker’s status under the IRS test by filing IRS Form SS-8.

Workers’ compensation laws. The test for independent contractor status under workers’ compensation laws varies from state to state. To find out more about the workers’ compensation test in a given state, employers may contact the state department of industrial relations or the state labor department. See State Workers’ Compensation Officials.

State laws. Some states may have different or more-restrictive independent contractor classification rules. Several states, such as California, use their own three-factor test, also known as an “ABC” test, where three main criteria must be met. Each employer should check the laws in the states in which they wish to hire independent contractors to ensure compliance. SeeHow do I know if an individual is considered an employee or independent contractor in California?

Legal Ramifications of Misclassification

Classifying a gig worker as an independent contractor should always be an informed and bona fide business decision, not a subterfuge to avoid the employer’s obligations to employees. Misclassification of an individual as an independent contractor can give rise to a variety of liabilities. SeeIndependent-Contractor Classifications May Need to Be Reviewed.

If the purported independent contractor arrangement is between two organizations, that is, between the organization receiving the services and the organization that actually engages the workers, there is a risk of being found to be a joint employer—a legal relationship in which both client and contractor can be liable for violations of employment laws. SeeHow to Minimize Staffing Agency Snags.

TAX CONSEQUENCES

Employers are required to withhold income taxes based on information employees provide on IRS Form W-4. If an employer fails to withhold income taxes on behalf of a worker improperly classified as an independent contractor, and the individual has failed to pay the taxes, the employer may be liable for federal or state taxes that were required to be withheld but were not.

Furthermore, independent contractors are not eligible to receive tax-free benefits from the organization. If the company chooses to offer health care benefits to an independent contractor, the contractor must pay income taxes on the value of the benefit. If the company includes an independent contractor in its defined benefit pension plan, it risks losing the tax-exempt status of the plan. SeeWhat Benefits Can Companies Offer Gig Workers?

Additionally, beginning with tax year 2020, employers must use Form 1099-NEC to report nonemployee compensation rather than the 1099-MISC. SeeWhat is the difference between IRS Form 1099-NEC and Form 1099-MISC?

EMPLOYEE BENEFITS OBLIGATIONS

In Vizcaino v. Microsoft Corporation, the court found that Microsoft had mischaracterized certain workers as independent contractors and freelancers. Although the workers had been hired for specific projects, some continued to work on successive projects for several years. They were fully integrated into Microsoft’s workforce, and worked onsite and on work teams along with Microsoft’s regular employees. They also shared the same supervisors, performed identical functions and worked the same core hours as regular employees. Microsoft provided them with admittance card keys, office equipment and supplies. However, as independent contractors, these workers were not eligible for the same employee benefits that Microsoft’s regular employees received. Microsoft reached a settlement for $96.89 million and was subsequently assessed approximately $27.13 million in attorney fees and costs.

WORKERS’ COMPENSATION

A misclassified gig worker can result in the supposed employer being held liable for on-the-job injuries outside the protections of the workers’ compensation system, and for penalties as well.

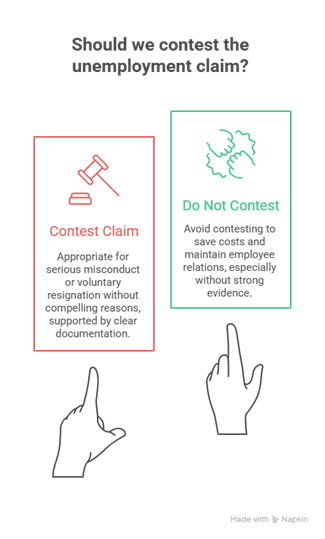

UNEMPLOYMENT COMPENSATION

A worker may file a claim for unemployment compensation and be granted benefits if the unemployment agency believes that the worker was misclassified as an independent contractor. If the organization misclassified the worker, it may be liable for penalties and interest in addition to unpaid unemployment insurance premiums. SeeNew York Uber Drivers Can Collect Unemployment Benefits.

WAGE AND HOUR LIABILITY

The widespread use of gig workers invites the scrutiny of plaintiffs’ attorneys who may be eager to bring a class- or collective-action suit for unpaid overtime or minimum wage violations under the Fair Labor Standards Act (FLSA) or state wage and hour laws. SeeWage and Hour Class Actions Can Cost Employers Millions.

VICARIOUS LIABILITY

An employer may incur liability for wrongful acts of a worker who it has mistakenly classified as an independent contractor. Even when an individual has been correctly classified as an independent contractor, an employer may still be liable for work that is considered “inherently dangerous activity,” or if the employer exercises control over the work or the activity that caused harm to a third party. (SHRM)

Independent Contractor Tax Information

The 1099-MISC form has been used in the past to report certain payments, including nonemployee compensation (NEC), to the IRS. Beginning with tax year 2020, the 1099-MISC has been redesigned due to the creation of Form 1099-NEC. Employers will no longer report nonemployee compensation, such as payments to independent contractors, on Form 1099-MISC.

Form 1099-NEC

Beginning with tax year 2020, employers must use Form 1099-NEC to report nonemployee compensation. If the following four conditions are met, you must generally report a payment as nonemployee compensation:

- You made the payment to someone who is not your employee.

- You made the payment for services rendered in the course of your trade or business (including government agencies and nonprofit organizations).

- You made the payment to an individual, a partnership, an estate or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year.

Common examples of nonemployee compensation include payments to independent contractors, fees paid for professional services such as of attorneys and accountants, and commissions paid to nonemployee salespersons that are subject to repayment but not repaid during the calendar year.

Employers are required to furnish Form 1099-NEC to the payee and file with the IRS by January 31 (February 1 in 2021, since January 31 falls on a Sunday).

Form 1099-NEC example:

Form 1099-MISC

According to the IRS, beginning with tax year 2020, you should file Form 1099-MISC for each person to whom you have paid the following in the course of your business during the year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in the following:

- Rents.

- Prizes and awards.

- Other income payments.

- Generally, cash from a notional principal contract to an individual, a partnership or an estate.

- Any fishing boat proceeds.

- Medical and health care payments.

- Crop insurance proceeds.

- Payments to an attorney.

- Section 409A deferrals.

- Nonqualified deferred compensation.

Employers must furnish the Form 1099-MISC to the recipient by January 31 and file with the IRS by February 28 (March 31 if filing electronically). For 2021, the due dates are February 1 to the recipient and March 1 to the IRS.

For detailed instructions and examples for both forms, see Instructions for Forms 1099-MISC and 1099‑NEC.

IRS Independent Contractor Website

https://www.irs.gov/forms-pubs/about-form-w-9

Checklist: Utilizing Independent Contractors

Contract Development

☐ Review Department of Labor and IRS criteria to ensure an independent contractor relationship.

☐ Use Form SS-8 for IRS determination of independent contractor status if unclear and the determination cannot be made by the business.

☐ Develop a written agreement with an assigned specific scope of work for a specific duration.

☐ Do not have a contractor complete an employment application.

☐ Require the contractor to supply his or her own workers’ compensation and liability insurance.

☐ Require the contractor to supply his or her own equipment and tools.

☐ Establish invoicing requirements and payment dates.

☐ Do not pay contractor expenses; expenses should be built into the contract for the cost of the entire job.

☐ Do not provide continuing education training. The company may provide training specific to the assignment or company procedures.

☐ Do not have contractors perform similar work of employees or perform routine work.

☐ Contractor work should not be close to core business operations and therefore considered employee-type work.

☐ Require documentation demonstrating an independent contractor relationship, such as a copy of business or professional license, copy of insurance certificates, copies of the independent contractor’s advertising, and copy of the contractor’s business card and stationery.

Contract Signed; Contractor Work to Begin

☐ Require the contractor complete Form W-9, Request for Taxpayer Identification Number and Certification. This form can be used to request the correct name and taxpayer identification number, or TIN, of the worker. A TIN may be either a Social Security number (SSN) or an employer identification number (EIN).

☐ Do not complete an I-9 form.

☐ Do not pay contractors from a payroll account.

☐ Do not provide an employee handbook.

☐ Do not allow independent contractors to enroll in any company-sponsored benefit plans or offer other benefits.

☐ Do not invite or permit contractors to attend company parties or special events intended for employees.

☐ Do not issue company business cards or employee ID badges to contractors.

☐ Restrict contractor participation in projects or department meetings.

☐ Do not give independent contractors authority for hiring, disciplinary action or termination decisions.

☐ Do not require the contractor to work “full time” or have set hours. Contractors should control when and how they work.

☐ Do not conduct performance evaluations similar to employee evaluations. Companies should require deadlines and results and can require contractors to follow job and company rules.

Contract Work in Progress (1 month to end of contract)

☐ Periodically review the contract and assigned scope of work to ensure contractor is working within the contract scope and maintaining independent contractor status.

☐ Confirm with company contact(s) that the contractor has not been provided additional duties or benefits outside the scope of the contract or anything else that would jeopardize independent contractor status.

☐ Retain records of all transactions with the contractor, such as the contractor’s invoices for billing.

Ongoing

☐ Review IRS criteria to ensure company is maintaining an independent contractor relationship.

☐ Confirm W-9 is on record and retained for four years.

☐ Send form 1099-NEC each year for any contractor (e.g., attorney, accountant, consultant) paid $600 or more for services provided during the year.

☐ Review W-9 Record Retention Schedule to purge unneeded files.

☐ Retain W-9 for four years for future reference in case of any questions from the worker or the IRS.

☐ Destroy records that have met the retention requirements unless employer is involved in a dispute that has not yet been resolved.

Draft Independent Contractor Agreement (Review State or Local Law)

This independent contractor agreement (Agreement) is entered into this ____ day of ______________, 20__, by and between ______________(Corporation), and _______________________________, an independent contractor (Contractor), in consideration of the mutual promises made herein, as follows:

Term of Agreement

This Agreement will become effective on the ______ day of _______________, 20__, and will continue in effect until: ________, 20__.

Services to be Rendered by Contractor

Contractor agrees to provide the following services:

____________________________________________________________________________

Method of Performing Services:

Contractor will determine the method, details, and means of performing the above-described services, including the determination of the need for and hiring of assistants at the Contractor’s own expense. The Corporation may not control, direct or otherwise supervise Contractor’s assistants or employees in the performance of those services.

Compensation:

In consideration for the services to be performed by Contractor, Corporation agrees to pay Contractor the sum of ________________________ dollars ($__________), upon completion of the work to be performed.

Tools and Instruments:

Contractor will supply all tools, equipment and supplies required to perform the services under this Agreement.

Workers Compensation:

Contractor agrees to provide workers’ compensation insurance for Contractor’s employees and agents and agrees to hold harmless and indemnify Corporation for any and all claims arising out of any injury, disability, or death of any of Contractor’s employees or agents.

Insurance:

Contractor agrees to maintain a policy of insurance in the minimum amount of _________________ Dollars ($__________) to cover any negligent acts committed by Contractor or Contractor’s employees or agents during the performance of any duties under this Agreement. Contractor further agrees to hold Corporation free and harmless from any and all claims arising from any such negligent act or omission.

Obligations of Corporation

Corporation agrees to meet the terms of all reasonable requests of Contractor necessary to the performance of Contractor’s duties under this Agreement.

Assignment:

Neither this Agreement nor any duties or obligations under this Agreement may be assigned by Corporation or Contractor without the prior written consent of Contractor and Corporation.

Termination of Agreement:

Notwithstanding any other provisions of this Agreement, either party hereto may terminate this Agreement at any time by giving ________ days written notice to the other party.

General Provisions

Notices:

Any notices to be given hereunder by either party to the other may be made either by personal delivery or by mail, registered or certified, postage prepaid with return receipt requested. Mailed notices shall be addressed to the parties at the following addresses:

Corporation: ______________________________________________________________

Contractor: _______________________________________________________________

Each party may change the above address by written notice in accordance with this paragraph. Notices delivered personally shall be deemed communicated as of the date of actual receipt; mailed notices shall be deemed communicated as of three (3) days after the date of mailing.

Entire Agreement:

This Agreement supersedes any and all other agreements, either oral or in writing, between the parties hereto with respect to the performance of services by Contractor for Corporation and contains all of the covenants and agreements between the parties with respect to the rendering of such services in any manner whatsoever. Each party to this Agreement acknowledges that no representations, inducements, promises or agreements, orally or otherwise, have been made by any party, or anyone acting on behalf of any party, which are not embodied herein, and that no other agreement, statement, or promise not contained in this Agreement shall be valid or binding. Any modification of this Agreement will be effective only if it is in writing signed by the party to be charged.

Partial Invalidity:

If any provision of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remaining provisions shall nevertheless continue in full force without being impaired or invalidated in any way.

Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of ________________________________.

Corporation, by _____________________ Date______________________________

Contractor, by ______________________ Date ______________________________

Invoice Template

[ADD LOGO/IMAGE] HOURLY CONTRACTOR

INVOICE

DETAILS

DATE: 2/1/2025

INVOICE NO. [#]

FROM BILL TO

[COMPANY NAME] [COMPANY NAME]

[ATTN] [ATTN]

[STREET ADDRESS] [STREET ADDRESS]

[CITY, STATE, ZIP CODE] [CITY, STATE, ZIP CODE]

[PHONE] [PHONE]

[E-MAIL] [E-MAIL]

DESCRIPTION QUANTITY UNIT PRICE AMOUNT ($)

NOTES: ___________________________________________

__________________________________________________

__________________________________________________

SUBTOTAL

DISCOUNT

TAX / VAT

TOTAL

THANK YOU FOR YOUR BUSINESS

Identify Required Posters: Create a comprehensive list of all federal, state, and local labor law posters required for each location. Utilize online resources, legal counsel, or labor law poster compliance services to ensure accuracy.Physical Inspection: Conduct a physical inspection of each workplace to verify that all required posters are displayed in conspicuous locations where employees can easily access and read them. Common locations include break rooms, employee entrances, and near-time clocks.Poster Content Review: Carefully examine each poster to ensure it is the most current version. Labor laws are subject to change, and outdated posters can lead to non-compliance. Check for revision dates or contact the relevant government agency to confirm the poster’s validity.Accessibility Assessment: Evaluate the accessibility of the posters for all employees, including those with disabilities. Ensure that posters are displayed at an appropriate height and are readable. Consider providing posters in multiple languages if a significant portion of the workforce speaks a language other than English.Documentation: Maintain detailed records of the audit, including the date of the audit, the locations inspected, the posters reviewed, and any identified deficiencies. This documentation will be valuable for demonstrating compliance and tracking progress in addressing any issues.

Identify Required Posters: Create a comprehensive list of all federal, state, and local labor law posters required for each location. Utilize online resources, legal counsel, or labor law poster compliance services to ensure accuracy.Physical Inspection: Conduct a physical inspection of each workplace to verify that all required posters are displayed in conspicuous locations where employees can easily access and read them. Common locations include break rooms, employee entrances, and near-time clocks.Poster Content Review: Carefully examine each poster to ensure it is the most current version. Labor laws are subject to change, and outdated posters can lead to non-compliance. Check for revision dates or contact the relevant government agency to confirm the poster’s validity.Accessibility Assessment: Evaluate the accessibility of the posters for all employees, including those with disabilities. Ensure that posters are displayed at an appropriate height and are readable. Consider providing posters in multiple languages if a significant portion of the workforce speaks a language other than English.Documentation: Maintain detailed records of the audit, including the date of the audit, the locations inspected, the posters reviewed, and any identified deficiencies. This documentation will be valuable for demonstrating compliance and tracking progress in addressing any issues.