I have written about New York State Paid Family Leave three or four times over the past 8 months, and will more than likely write a few more articles about the legislation as we approach deadlines and implementation in 2018. We are still patiently waiting for final rules and regulations to be issued from the New York State Workers’ Compensation Board, which continue to be communicated slowly to employers and insurance companies. Continue to monitor for any changes that can and will impact your organization.

Below are 6 Need to Knows about NYSPFL as we approach 1/1/2018:

- Employer Eligibility: Qualifying reasons for leave under current PFL include; bonding with a new child (birth, adoption or placement in foster care), employee providing care for a child, parent, grandparent, grandchild, spouse or domestic partner with a serious health condition and qualifying exigencies arising from military services of the employee’s spouse, domestic partner, child, or parent. Serious health condition or qualifying exigencies, follow the same guidelines that we see under the Family Medical Leave Act (FMLA)

- New York State’s Average Weekly Wage: The current average weekly wage is $1,305.92. On March 31st of each calendar year, the rate is recalculated by the New York State Department of Labor. More than likely, we will see this rate continue to increase year over year.

- Employer’s Obligation to Fund Paid Family Leave: “Although employers are required to provide PFL benefits to eligible employees, employers are not required to pay anything towards the cost of those benefits. Paid family leave is intended to be 100% employee-funded.”[i] The Worker’s Compensation Board has yes to publish all rules in this area, continue to monitor for additional updates and new guidelines.

- Maximum Deductions: The most that can be deducted is 0.126% of the New York State average weekly wage. This will be for an employee’s weekly wage.

- Insurance or Self-Insure: The employer can forego obtaining insurance and has the option to self-insure. Currently, the employer must elect to do so and file the required paperwork with New York State, no later than September 30, 2017.

- Employer’s Offering Benefits That Exceed NYSPFL: If an employer is already offering paid family leave that exceed the legal requirements and pay full salary during leave, the employer may request reimbursement from the insurance carrier for advance payment of benefits. The employee is not entitled to add-on or double dip NYSPFL or short-term disability. Benefits are limited to a total of 26-weeks; paid family leave and disability.

As we approach January 1, 2018, continue to watch for updated rules and regulations from the New York State Worker’s Compensation Board. There are still unanswered questions and areas of the legislation that need to be clarified. Organizations should now be working with insurance companies or determining if they would like to be self-insured. Do not wait until the last minute to begin implementing, taking deductions or communicating with the workforce. The law is complex, seek guidance if you are confused.

New York State Paid Family Leave Resource Website

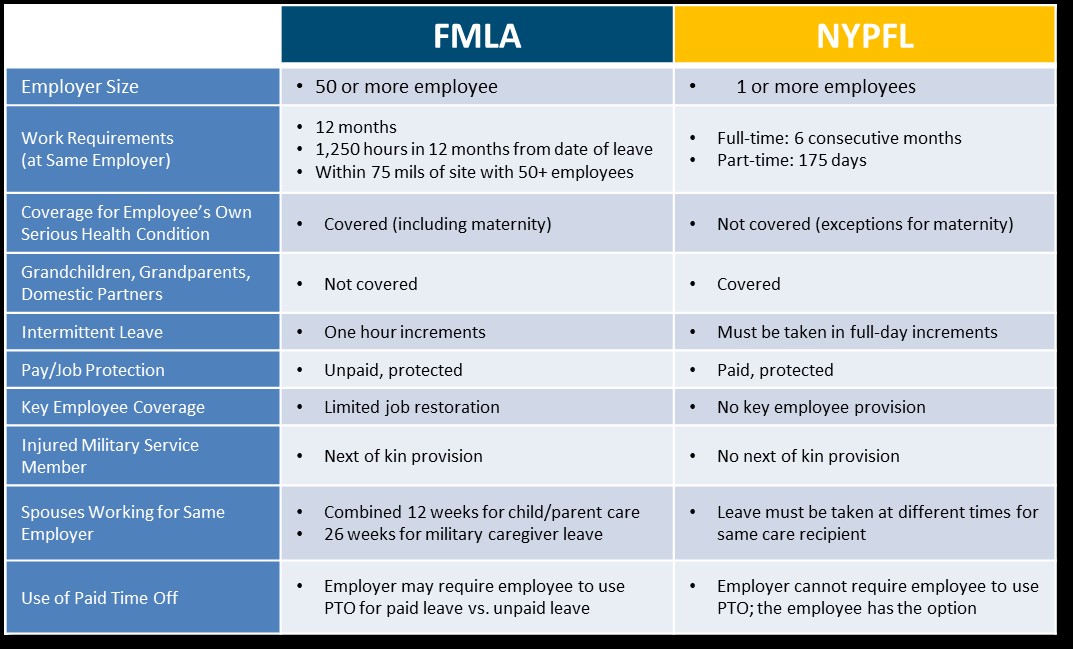

FMLA & NYPFL – Key Differences

– Matthew Burr, HR Consultant

[i] https://www.bsk.com/media-center/3746-labor-employment-faqs-mdash-things-you-want-and-need-know-about#.WWfMyYVh068.linkedin

[ii] Guardian NYSPFL Presentation