Upcoming New York State Minimum Wage, Executive & Administrative Exempt Salary Changes, Farm Overtime Threshold Reductions and Nationwide Changes

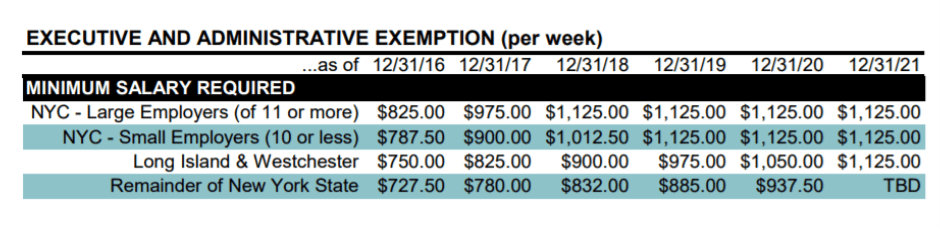

As you know, this will also impact the minimum salary levels to be paid to Executive and Administrative exempt employees. The new minimum wage and minimum salary levels can be found below. Things to keep in mind:

- The updated poster. You will be required to post a new minimum wage poster. You will be able to find the new poster here. Remember, there could be corresponding increases in the tipped wage and wages paid for fast food employees in your area.

- The minimum salary level to be considered exempt from overtime under NYS law for Executive and Administrative employees is tied to the minimum wage and may also be increasing for your industry and area. Remember, there is no NYS minimum salary level for Professional exemptions. For Professional employees you would be subject to the Federal minimum salary level.

Minimum Wage Increases

Once adopted, the FY2024 Budget would establish a new statutory minimum wage rate schedule in Section 652 of the Labor Law as follows:

Indexing the Minimum Wage

Starting January 1, 2027, additional annual minimum wage increases would be implemented each year based on the Northeast region measure of consumer price increases for urban wage earners and clerical workers (CPI-W). There would be no increases to the minimum wage if over a period of the prior year, the calculations published by the United States Department of Labor show that:

- The CPI-W for Northeast Region Urban Wage Earners is negative.

- The statewide unemployment rate increases by one-half percentage point or more.

- Total non-farm employment decreases (measured seasonally).

Adjusted minimum wages are required to be published by the State Department of Labor no later than October 1st of each year.

Adjustments to Salary Thresholds, Allowances, and Gratuities

It is worth noting that minimum wage orders in effect would remain in effect, including wage orders that address minimum salary levels for executive and administrative exemptions, gratuities, and allowances for meals, apparel, etc. As these minimum wage increases take effect, the State Department of Labor would amend the wage orders to increase all monetary amounts (i.e., salary levels and allowances) in the same proportion as the increase in the hourly minimum wage. The state is expected to publish the official amounts of these adjustments. We calculate the salary threshold in 2024 for downstate would rise to $1,200 weekly, and the upstate salary basis threshold would rise to $1,125 weekly.

The wage for food service workers who receive tips would remain lower than the regular minimum wage by one-third and rounded to the nearest five cents. While the state has not issued its official calculations, our unofficial calculations for tipped food service workers in the Hospitality Industry would be as follows:

| TIPPED FOOD SERVICE WORKERS | ||

| Year | New York City, Westchester, Nassau, Suffolk Counties | Upstate New York |

| 2024 | $10.70 | $10.00 |

| 2025 | $11.00 | $10.35 |

| 2026 | $11.35 | $10.70 |

| 2027+ | $11.35 + annual increase | $10.70 + annual increase |

NYS Reduces Overtime Threshold for Farm Workers to 40 hours Per Week

New York State Department of Labor (NYSDOL) Commissioner Roberta Reardon issued an order accepting the recommendation of the Farm Laborers Wage Board to lower the current 60-hour threshold for overtime pay to 40 hours per week by January 1, 2032, allowing 10 years to phase in the new threshold. NYSDOL will now be undergoing a rule making process which will include a 60-day public comment period. This applies to certain agricultural employers and employees only.

Under proposed language, an employer shall pay an employee for overtime at a wage rate of one- and one-half times the employee’s regular rate of pay for hours worked in excess of the following number of hours in one workweek:

(a) 60 hours on or after January 1, 2020;

(b) 56 hours on or after January 1, 2024;

(c) 52 hours on or after January 1, 2026;

(d) 48 hours on or after January 1, 2028;

(e) 44 hours on or after January 1, 2030;

(f) 40 hours on or after January 1, 2032.

Minimum Wage for Fast Food Employees

The minimum wage for fast food employees working outside of New York City will increase to $14.50 per hour. The final scheduled increase to $15.00 per hour will take effect on July 1, 2021.

What is a living wage?

Currently, as of November 8th, 2023 in Tompkins County the living wage is $18.45/hour for a single person. This is based upon the following from a detailed study produced by a team from the Ithaca and Buffalo Co-Labs of Cornell’s School of Industrial and Labor Relations led by ILR Co-Lab Researchers, Ian Greer and Rusty Weaver. The latest study was updated to take into account the extreme inflation that took place this past year. Read more about the latest study.

- Rent………………………………………………………………………….$1276.00/month

- Transportation………………………………………………………..$ 320.02/month

- Food…………………………………………………………………………$ 282.75/month

- Health care – Insurance & out of pocket……………….$203.43/month

- Savings…………………………………………………………………….$ 77.53/month

- Recreation……………………………………………………………… $137.54/month

- Communication…………………………………………………….. $111.40/month

- Miscellaneous………………………………………………………….$175.80/month

- Taxes………………………………………………………………………….$613.25/month

TOTAL………………………………………………………………………………….$3,197.72/month

$38,373/year or $18.45/hour (based on 2,080/hours a year)

Current Study

MIT Living Wage Calculator

Below are the 2024-2025 New Hire Forms

- Form I-9, Eligibility to work in the United States: This form is required in every state for new hires. Organizations must verify that new employees are legally eligible to work in the United States. Ensure the form is filled out correctly and signed by the right person in the organization, audits are a great option for an organization to review old I-9 forms.

- Form W-4, wage Withholding Allowance Certificate: This form is necessary for federal withholdings. All employees should complete and sign a Form W-4 prior to starting work. The 2025 is pending.

- Form IT-2104, Employer Allowance Certificate (NYS):This is the New York State withholding form required for all new employees or any revised withholding information.

Wage Theft Prevention Act New York State Forms

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011.

The law requires employers to give written notice of wage rates to each new hire.

The notice must include:

- Rate or rates of pay, including overtime rate of pay (if it applies)

- How the employee is paid: by the hour, shift, day, week, commission, etc.

- Regular payday

- Official name of the employer and any other names used for business (DBA)

- Address and phone number of the employer’s main office or principal location

- Allowances taken as part of the minimum wage (tips, meal and lodging deductions)

The notice must be given both in English and in the employee’s primary language (if the Labor Department offers a translation). The Department currently offers translations in the following languages: Spanish, Chinese, Haitian Creole, Korean, Polish and Russian.

Sample Pay Notices

The employer may provide its own notice, as long as it includes all of the required information, or use the Department’s sample notices.

More Information

The WTPA also included other provisions that employers need to know, such as stronger protections for whistleblowers and increased penalties for wage theft.

Employers are strongly encouraged to review the Wage Theft Prevention Act Fact Sheet, and the Wage Theft Prevention Act Frequently Asked Questions.

Hourly Rate Employees

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Hourly Rate Employees LS 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Multiple Hourly Rate Employees

Multiple Hourly Rate Employees

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Multiple Hourly Rate Employees LS 55 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week)

Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week)

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week) LS 56 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Employees Paid Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Employees Paid Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay LS 57 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Prevailing Rate and Other Jobs

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Prevailing Rate and Other Jobs LS 58 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Exempt Employees

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Exempt Employees LS 59 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Notice for Hourly Rate Employees

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law for Home Care Aides Wage Parity and Other Jobs (LS62)

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law for Home Care Aides Wage Parity and Other Jobs

Pay Notice and Acknowledgement for Farm Workers

Pay Notice and Acknowledgement for Farm Workers

New York State Department of Labor Form LS 309 is a blank farm work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. This agreement must be completed to comply with the Wage Theft Prevention Act.

It should be given to the employee in his or her primary language if that language is available. If the employee’s primary language is not available above, then the form should be given to the employee in English.

Wage Statements for Agricultural Employers

Wage Statements for Agricultural Employers

New York State Department of Labor Form AL 447 is a blank wage statement. It contains all of the fields that employers of year-round or seasonal workers must provide to document each pay period to comply with the Wage Theft Prevention Act.

New York State Department of Labor Form AL 446 is a sample of a completed wage statement for agricultural workers.

Additional Information

Visit the Division of Labor Standards for additional information about New York’s Wage Theft Prevention Act and what is required of employers and workers.

- 2019 W-9 Form: (Revised October 2018) these forms are utilized for consultants and others that might be working within your organization. This form was updated in October 2018. Ensure you have an updated form from any consultants or others that are issued a 1099. No current changes.

- FMLA Forms: “The Family and Medical Leave Act (FMLA) provides certain employees with up to 12 weeks of unpaid, job-protected leave per year. It also requires that their group health benefits be maintained during the leave.

FMLA is designed to help employees balance their work and family responsibilities by allowing them to take reasonable unpaid leave for certain family and medical reasons. It also seeks to accommodate the legitimate interests of employers and promote equal employment opportunity for men and women.

FMLA applies to all public agencies, all public and private elementary and secondary schools, and companies with 50 or more employees. These employers must provide an eligible employee with up to 12 weeks of unpaid leave each year for any of the following reasons:

- For the birth and care of the newborn child of an employee;

- For placement with the employee of a child for adoption or foster care;

- To care for an immediate family member (i.e., spouse, child, or parent) with a serious health condition; or

- To take medical leave when the employee is unable to work because of a serious health condition.

Employees are eligible for leave if they have worked for their employer at least 12 months, at least 1,250 hours over the past 12 months, and work at a location where the company employs 50 or more employees within 75 miles. Whether an employee has worked the minimum 1,250 hours of service is determined according to FLSA principles for determining compensable hours or work.” (DOL Website)

FMLA Notice Forms

Employers covered by the FMLA are obligated to provide their employees with certain critical notices about the FMLA so that both the employees and the employer have a shared understanding of the terms of the FMLA leave. For more information on satisfying the FMLA’s employer notification requirements, see WHD Fact Sheet # 28D: Employer Notification Requirements under the Family and Medical Leave Act.

Employers can use the following forms to provide the notices required under the FMLA.

- General Notice, the FMLA poster – satisfies the requirement that every covered employer display or post an informative general notice about the FMLA. This notice can also be used by employers with eligible employees to satisfy their obligation also to provide FMLA general notice to employees in written leave guidance (e.g., handbook) or individually upon hire.

- Eligibility Notice, form WH-381 – informs the employee of his or her eligibility for FMLA leave or at least one reason why the employee is not eligible.

- Rights and Responsibilities Notice, form WH-381 (combined with the Eligibility Notice) – informs the employee of the specific expectations and obligations associated with the FMLA leave request and the consequences of failure to meet those obligations.

- Designation Notice, form WH-382 – informs the employee whether the FMLA leave request is approved; also informs the employee of the amount of leave that is designated and counted against the employee’s FMLA entitlement. An employer may also use this form to inform the employee that the certification is incomplete or insufficient and additional information is needed.

Certification Forms

Certification is an optional tool provided by the FMLA for employers to use to request information to support certain FMLA-qualifying reasons for leave. An employee can provide the required information contained on a certification form in any format, such as on the letterhead of the healthcare provider, or official documentation issued by the military.

Please do not send any completed certification forms to the U.S. Department of Labor, Wage and Hour Division. Return completed certifications to the employee to provide to his or her employer.

There are five DOL optional-use FMLA certification forms.

Certification of Healthcare Provider for a Serious Health Condition

- Employee’s serious health condition, form WH-380-E – use when a leave request is due to the medical condition of the employee.

- Family member’s serious health condition, form WH-380-F – use when a leave request is due to the medical condition of the employee’s family member.

Certification of Military Family Leave

- Qualifying Exigency, form WH-384 – use when the leave request arises out of the foreign deployment of the employee’s spouse, son, daughter, or parent.

- Military Caregiver Leave of a Current Servicemember, form WH-385 – use when requesting leave to care for a family member who is a current service member with a serious injury or illness.

- Military Caregiver Leave of a Veteran, form WH-385-V – use when requesting leave to care for a family member is who a covered veteran with a serious injury or illness.

2024 IRS Mileage Rate:

Standard Mileage Rate Website (Additional Information)

Additional National Changes:

Alaska (updated 11.15.2023)

To be classified as exempt from overtime under state law (Alaska Statute 23.10.055), bona fide administrative, professional and executive employees must satisfy certain salary and duties tests. The minimum salary required for exemption is two times the state minimum wage for the first 40 hours of employment each week. As a result of a change in the state’s minimum wage, the minimum salary required for these exemptions under state law will increase to $938.40 per week on January 1, 2024.

California

To qualify for the administrative, professional and executive exemptions in California, employees must meet certain salary and duties tests and must be paid at least twice the state minimum hourly wage based on a 40-hour week. The state’s minimum wage will increase on January 1, 2024. As a result, employers must pay a salary of at least $1,280 per week beginning January 1, 2024 to qualify for the exemption.

Computer software employees may be paid on an hourly or a salary basis in order to qualify for exemption from California’s overtime requirements. Beginning January 1, 2024, computer software employees who are paid on an hourly basis must earn at least:

- $55.58 per hour (for all hours worked); or

- A monthly salary of $9,646.96; and

- An annual salary of $115,763.35.

Colorado

In Colorado, employees must meet certain salary and duties tests to qualify for overtime exemption. As a result of the Colorado Overtime & Minimum Pay Standards Order, the minimum salary required to qualify for the executive/supervisor, administrative and professional exemptions under state law will increase to $1,057.69 per week on January 1, 2024.

Under the state’s exemption for highly technical computer employees, the employee may be paid by salary (at least $1,057.69 per week in 2024) or by the hour. The minimum hourly rate for 2024 for these employees hasn’t been published yet.

| Note: In Colorado, an exempt employee’s salary generally must also be sufficient to satisfy the minimum wage for all hours worked in a workweek. This is true in certain other states as well, some of which will have a new minimum wage in 2024. Employers may want to consult legal counsel about how this rule may impact them. |

Maine

To be classified as exempt from overtime under state law, administrative, professional and executive employees must satisfy certain salary and duties tests and receive a salary that exceeds 3,000 times the state minimum wage divided by 52. Due to an increase in the state’s minimum wage, the minimum salary required for the administrative, professional and executive exemptions from overtime under state law will increase to $816.35 per week on January 1, 2024.

Washington

In Washington, employees must satisfy certain salary and duties tests to be classified as exempt from overtime under state law. As a result of a new state minimum wage, the salary threshold used to determine which workers are exempt from overtime under state law will also increase to $1,302.40 per week effective January 1, 2024.

| Note: Employers may pay exempt computer professionals by the hour, provided they pay at least 3.5 times the minimum wage ($56.98 per hour in 2024). |

(ADP)

2025 New York State Paid Family Leave and Workers Compensation Rates

Up to 12 weeks of leave

New York State Paid Family Leave provides eligible employees with up to 12 weeks of job protected, paid time off to bond with a new child, care for a family member with a serious health condition, or to assist loved ones when a family member is deployed abroad on active military service. This time can be taken all at once, or in increments of full days.

At 67% of pay (up to a cap)

Employees taking Paid Family Leave receive 67% of their average weekly wage, up to a cap of 67% of the current New York State Average Weekly Wage (NYSAWW). For 2025, the NYSAWW is $1,757.19, which means the maximum weekly benefit is $1,177.32. This is $26.16 more than the maximum weekly benefit for 2024.

Employees can get an estimate of their benefits using the PFL 2025 Benefits Calculator.

| Paid Family Leave Benefits Examples | |

| Worker’s Average Weekly Wage | Weekly PFL Benefit* |

| $600 | $402 |

| $1,000 | $670 |

| $2,000 | $1,177.32 |

*The weekly PFL benefit is capped at $1,177.32(67% of the NYSAWW).

2023 Paid Family Leave Expansion

Through Legislation S.2928-A/A.06098-A, the definition of “family members” expands to include siblings. This includes biological siblings, adopted siblings, step-siblings and half-siblings. These family members can live outside of New York State, and even outside of the country.

Employer Resources

There are several resources to help employers understand and communicate New York Paid Family Leave benefit updates to their employees.

- PFL At-A-Glance [PDF]

- Model Language for Employee Materials – Updated for 2025 (template)

- Employee Notice of Paid Family Leave Payroll Deduction for 2025 (template)

- Statement of Rights for Paid Family Leave (PFL-271S)

Draft PFL Policy Language:

NEW YORK STATE PAID FAMILY LEAVE

New York Paid Family Leave provides job-protected, paid time off so employees can:

- bond with a newly born, adopted, or fostered child.

- care for a close relative with a serious health condition; or

- Assist loved ones when a family member is deployed abroad on active military service.

By NYS PFL Definition:

- spouse

- domestic partner (including same and different gender couples; legal registration not required)

- child/stepchild and anyone for whom you have legal custody

- parent/stepparent

- parent-in-law

- grandparent

- grandchild

- sibling (starting in 2023) Workers should check with their employer’s Paid Family Leave insurer to learn when sibling care goes into effect for their policy. For employees who work for self-insured employers, coverage begins January 1, 2023.

Employees who believe they are eligible for Paid Family Leave should contact their _______ as soon as possible. More information can be found at www.ny.gov/programs/new-york-state-paid-family-leave. Organization will abide by all changes to NYSPFL and communicate such changes to the employees. For additional information please alert your President, or the Statement of Rights Posting on Paid Family Leave.

Legal Area’s and Changes to Remember and Communicate:

- Employees have job protection, similar to FMLA.

- Paid Sick Leave policies and procedures.

- Right to keep their health insurance while on leave.

- No retaliation or discrimination against those who take leave.

- Citizenship is never a factor in eligibility for NYSPFL.

- Review the language contained in your employee handbook, policy, or policy manual. Update FMLA and NYSPFL language to reflect changes and communicate the policy to the workforce.

- Communicate PFL payroll deductions for 2020 to the workforce now or during open enrolment. My recommendation is to do this in writing via a template and obtain a signature. NYS has a PDF template referenced above.

- Ensure the NYS PFL statement of rights for Paid Family Leave in 2023 is up-to-date and communicated to the workforce. This includes the postings; disability provider or state is providing these postings to employers. Watch the expiration dates on the postings, this is a common area in an audit that needs to be corrected.

- A proper call-in procedure for intermittent leave is necessary. Do you accept text messages? What about emails? This should all be clearly communicated in a policy or procedure. How much notice?

- New York State Paid Sick Leave

I am happy to work with any employer’s on ensuring policy, communication mechanisms, postings and other NYSPFL material is legal and up to date. Ensure you are reviewing this information annually and communicating changes to PFL rates annually. Work with your payroll provider to ensure and verify the percentage deductions are accurate and live in the payroll system. Remember interns and seasonal employees and communicate if they do or do not qualify for PFL. There are forms to fill out online if they do not qualify to ensure the deduction is not taken.

Frequently Asked Questions

How many weeks of Paid Family Leave are available to employees? Eligible employees can take up to 12 weeks of Paid Family Leave.

How much will employees get paid when taking Paid Family Leave? Employees taking Paid Family Leave in 2025 will get 67% of their average weekly wage, up to a cap of 67% of the NYSAWW of $1,757.19.

What is the maximum weekly benefit? The maximum weekly benefit for 2025 is $1,177.32.

If I start my continuous leave in one year and it extends into the next, what will my benefit rate be? You get the benefit rate in effect on the first day of your leave.

If I start my intermittent leave in 2024, and it extends into 2025, am I eligible for the benefits at the 2025 rate? You get the benefit rate in effect on the first day of a period of leave. When more than three months pass between days of Paid Family Leave, your next day or period of Paid Family Leave is considered a new claim under the law. This means you will need to file a new request for Paid Family Leave and that you may be eligible for the increased benefits available should that day or period of Paid Family Leave begin in 2025.

I am having a baby in 2024; can I wait until 2025 to take Paid Family Leave? Yes, you can take (and must complete) Paid Family Leave for bonding with a new child at any time within the first 12 months of the child’s birth, adoption, or foster care placement, provided that you remain an eligible, covered employee.

I used all 12 weeks of Paid Family Leave in the last year; can I take more Paid Family Leave this year if I experience another qualifying event? You may take up to 12 weeks of Paid Family Leave in every 52-week period based on a rolling calendar. This means that if you used the full 12 weeks of leave, the next time you would be eligible to take Paid Family Leave again is one year from your first day of leave.

What is the weekly employee contribution rate? If you are paid weekly, the payroll contribution is 0.388% of your gross weekly wages and is capped at an annual maximum of $354.53. If your gross weekly wages are less than the NYSAWW ($1,757.19 per week), you will have an annual contribution amount less than the annual cap of $354.53, consistent with your actual wages.

For example, if you earn about $27,000 a year ($519 a week), you will contribute about $2.01 per week.

If you are not paid weekly, the payroll contribution will be 0.388% of your gross wages for the pay period.

What is the maximum amount employees will pay for Paid Family Leave? The maximum employee contribution for 2025 is $354.53.

On March 31, 2024, New York updated the NYSAWW. When does this NYSAWW take effect for Paid Family Leave deduction and benefit caps? The new NYSAWW only applies to the 2025 benefit and will not affect Paid Family Leave deductions or benefits until January 1, 2025, if leave was begun on or after that date. The new NYSAWW does not have any impact on Paid Family Leave benefits in 2024.

What is the NYSAWW that will be used for Paid Family Leave benefits in 2025? $1,757.19.

Fully funded by employees

New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. For 2025, employees will contribute 0.388% of their gross wages per pay period, with a maximum annual contribution of $354.53.

Employees earning less than the current NYSAWW of $1,757.19 will contribute less than the annual cap of $354.53, consistent with their actual wages.

Here are some contribution and benefit examples at different income levels:

- Employees earning $519 a week (about $27,000 a year) will contribute about $2.01 from their gross wages each week ($519 x 0.388%). When taking the benefit, these employees will receive $347.73 per week, up to a maximum total benefit of $4,172.76.

- Employees earning $1,000 a week ($52,000 a year) will contribute about $3.88 from their gross wages each week ($1,000 x 0.388%). When taking the benefit, these employees will receive $670 per week, up to a maximum total benefit of $8,040.

- Employees earning the NYSAWW of $1,757.19 (about $91,300 a year) or more will contribute 0.388% from their gross wages each pay period until they reach the maximum of $354.53. When taking the benefit, these employees will receive $1,177.32, up to a maximum total benefit of $14,127.84.

Employees can get an estimate of their deductions using the PFL 2025 Payroll Deduction Calculator.

Paid Family Leave by State & City

Workers Comp Rates

The maximum weekly benefit rate for workers’ compensation claimants is two-thirds of the New York State average weekly wage for the previous calendar year, as determined by the New York State Department of Labor (Workers’ Compensation Law §§ 2[16] and 15[6]).

https://www.wcb.ny.gov/content/main/Workers/ScheduleMaxWeeklyBenefit.jsp

Workers Comp Rates

The maximum weekly benefit rate for workers’ compensation claimants is two-thirds of the New York State average weekly wage for the previous calendar year, as determined by the New York State Department of Labor (Workers’ Compensation Law §§ 2[16] and 15[6]).

https://www.wcb.ny.gov/content/main/Workers/ScheduleMaxWeeklyBenefit.jsp

- Qualified transportation fringe benefit. For tax year 2025, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking rises to $325, increasing from $315 in tax year 2024.

- Health flexible spending cafeteria plans. For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements rises to $3,300, increasing from $3,200 in tax year 2024. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount rises to $660, increasing from $640 in tax year 2024.

- Medical savings accounts. For tax year 2025, participants who have self-only coverage the plan must have an annual deductible that is not less than $2,850 (a $50 increase from the previous tax year), but not more than $4,300 (an increase of $150 from the previous tax year).

The maximum out-of-pocket expense amount rises to $5,700, increasing from $5,550 in tax year 2024.

For family coverage in tax year 2025, the annual deductible is not less than $5,700, increasing from $5,550 in tax year 2024; however, the deductible cannot be more than $8,550, an increase of $200 versus the limit for tax year 2024. For family coverage, the out-of-pocket expense limit is $10,500 for tax year 2025, rising from $10,200 in tax year 2024.

The Internal Revenue Service recently announced 2024 dollar limits for qualified retirement plans (including 401(k) plans), deferred compensation plans, and health and welfare plans. Adjustments to certain limits are based on a cost-of-living index.

In addition, the Social Security taxable wage base, which affects qualified retirement plans “integrated” with Social Security, typically adjusts each year. For 2024, the taxable wage base increases to $160,200.

For 2024, most limits increased with the exception of catch-up contributions limits and limits fixed by statute, the latter of which do not adjust based on the cost of living. The increased limits for 2024 are highlighted in bold below.

Qualified Retirement Plan Limits

| 2024 Limit | 2023 Limit | |

| Annual Limit on 401(k)/403(b) Deferral Contributions | $23,000 | $22,500 |

| Annual Limit on Age 50 and Older 401(k)/403(b) Catch-up Contributions | $7,500 | $7,500 |

| Annual Compensation Limit | $345,000 | $330,000 |

| Annual Contribution Limit for Defined Contribution Plans | $69,000 | $66,000 |

| Annual Benefit Limit for Defined Benefit Plans | $275,000 | $265,000 |

| Prior Year Compensation Amount for Determining Highly Compensated Employees | $155,000 | $150,000 |

| Key Employee Compensation Limit | $220,000 | $215,000 |

| Annual Limit on SIMPLE Contributions | $16,000 | $15,000 |

| Annual Limit on Catch-up Contributions to SIMPLE Plans | $3,500 | $3,500 |

| ESOP Account Balance Limit Subject to 5-Year Distribution Period | $1,380,000 | $1,330,000 |

| Incremental Amount Adding Additional Year(s) to ESOP 5-Year Distribution Period | $275,000 | $265,000 |

| Earnings Threshold for SEP Contribution | $750 | $750 |

Deferred Compensation Limits

| 2024 Limit | 2023 Limit | |

| Annual Limit on 457(b) Contributions | $23,000 | $22,500 |

| Annual Limit on Catch-up Contributions to 457(b) Plans | $7,500 | $7,500 |

| 409A Specified Employee Compensation Threshold | $220,000 | $215,000 |

| 409A Involuntary Separation Pay Limit | $690,000 | $660,000 |

Health and Welfare Plan Limits

| 2024 Limit | 2023 Limit | |

| Annual Limit on Salary Reduction Contributions to Health FSA | $3,200 | $3,050 |

| Annual Limit on Health FSA Carryover | $640 | $610 |

| Annual Limit on Salary Reduction Contributions to Dependent Care FSA | $5,000 if married filing jointly or if single $2,500 if married filing separately | $5,000 if married filing jointly or if single $2,500 if married filing separately |

| Annual Limit on HSA Contributions | $4,150 (EE only) $8,300 (family) | $3,850 (EE only) $7,750 (family) |

| Annual Limit on Catch-up Contributions to HSA | $1,000 | $1,000 |

| Annual Minimum Deductible for High Deductible Health Plans | $1,600 (EE only) $3,200 (family) | $1,500 (EE only) $3,000 (family) |

| Annual Limit on High Deductible Health Plan Out-of-pocket Expenses | $8,050 (EE only) $16,100 (family) | $7,500 (EE only) $15,000 (family) |